Compliance in action

Discover how businesses are turning to Scrive to transform compliance into a strategic advantage while enhancing customer trust.

Read article

Guest blog written by Salim Sayed

For many businesses, particularly those in banking and financial services, compliance and conversion rates present a difficult balancing act when it comes to KYC and onboarding. With regulators breathing down their necks and threats of significant fines, not to mention damage to their reputation looming around every corner, compliance tends to be the first priority.

In our customer conversations, we’ve heard business developers say that if their conversion rates drop below 5% their company is no longer competitive but we’ve also heard compliance officers say “If we believe there’s even a 1% chance that (a solution) is not compliant, we have to take it as an absolute certainty.”

“If we believe there’s even a 1% chance that (a solution) is not compliant, we have to take it as an absolute certainty.”

This creates friction between departments as one looks to maximise conversion, speed and profit while the other seeks to minimise risk. Sales often see compliance as a blocker or speed bump while compliance officers and legal teams lose sleep over what sales might be doing when they’re not looking.

Considering the fact that 1% off target for what is considered compliant could be the difference between a new customer and a court case, it’s understandable that businesses in an industry as highly regulated as banking would take the side of compliance.

But what if you didn’t have to choose? In other words, what if you could not only maintain but actually increase your conversion rates with the same solutions that help you achieve your compliance goals?

This may sound like a “too good to be true” situation to many of you out there, especially those of you who regularly participate in the tug of war between business development and compliance. However, not only are we saying it’s possible, we’ve actually helped a number of customers achieve this.

In order to give you the insight needed, we’re created two checklists which, when combined, should give you an idea of the steps needed in order to achieve better conversion while staying compliant in your KYC and onboarding journeys.

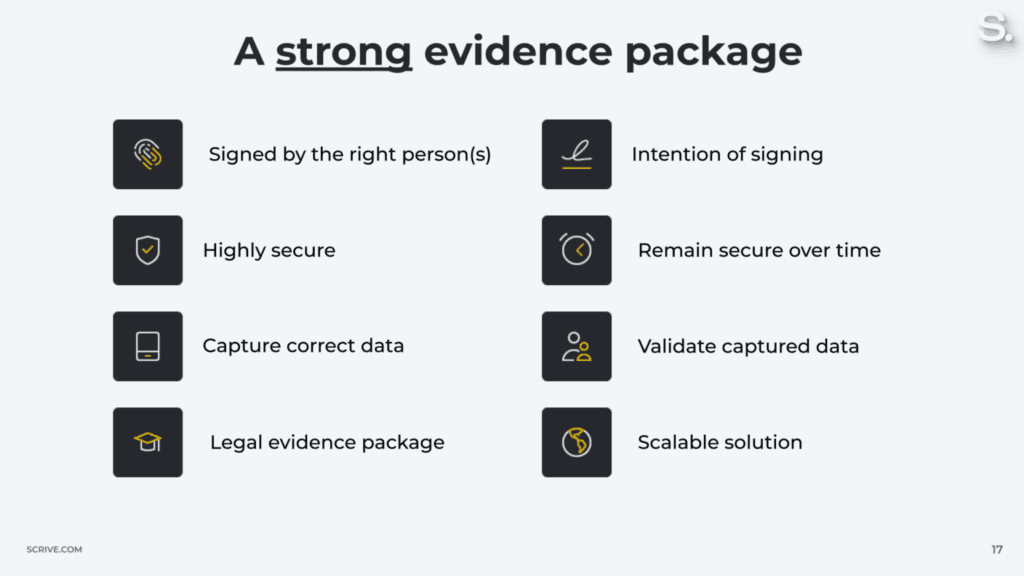

What does a “strong evidence package” mean? In short, it means you need to capture data that proves the identity of the other party, their intent to sign or agree to your terms, the process needs to be highly secure and you need to have a way to validate the data you’ve captured.

With Scrive’s e-signing and eID solutions, you’re able to do all this with the added bonus of the evidence package sealed with blockchain technology, meaning it’s tamper-proof.

A pleasant customer experience during onboarding is the best route towards a happy, engaged customer. So it’s very important to offer great customer experience in your KYC flow, otherwise you’re not only likely to cause frustration among your customers but you’ll probably face a high number of drop offs, causing your conversion rate to take a steep downward turn.

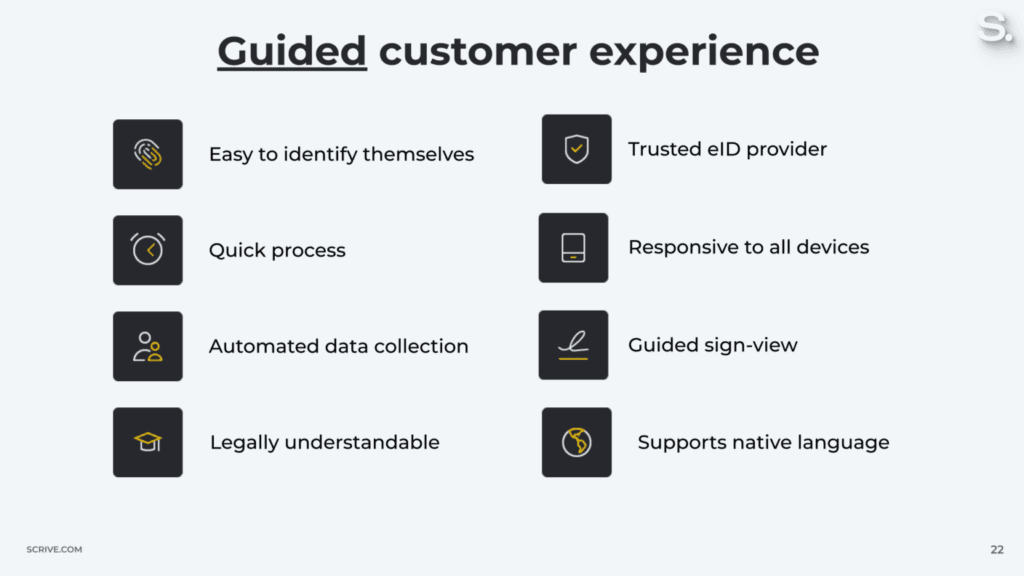

So how do you avoid this while still focusing on compliance? On top of the robust evidence package outlined above, you need to consider a guided customer experience. You need to make it easy for the customer to identify themselves and doing so with a trusted eID provider will both make the transaction more secure and is likely to inspire trust if the customer is already familiar with them.

Make sure the process is quick, accessible on any type of device and that it’s easily understandable. That last part refers to everything from the internal logic of the process and legal implications being easily understandable, to offering native language support across the board.

“Over 50% higher conversion combined with considerably reduced lead times and better automated communication with our customers.”

Carl Lönndahll, Head of Change & System Management, Nordnet

Discover how businesses are turning to Scrive to transform compliance into a strategic advantage while enhancing customer trust.

Read article

Explore how the regulatory landscape is redefining digital agreements and the impact of eIDAS 2.0 on identity verification.

Read article

We are excited to announce that Scrive is now Enity Bank Group’s exclusive provider of e-signature and ID verification solutions in the Nordics.

Read article