30min

Activation

Din Bil can now activate a new invoice customer in just 30 minutes. The shortest lead time with the old process was 1 full working day, and could take weeks.

Din Bil can now activate a new invoice customer in just 30 minutes. The shortest lead time with the old process was 1 full working day.

Din Bil can now activate a new invoice customer in just 30 minutes. The shortest lead time with the old process was 1 full working day, and could take weeks.

The Scrive process eliminates most manual admin steps and involves fewer Din Bil departments.

A common scenario at Din Bil’s service centers is a customer needing to pay by invoice, typically when bringing a company car in for service.

Setting up invoicing so the customer can drive away in their car or receive a new part was a manual process that involved the customer, the customer’s employer and multiple Din Bil departments.

The shortest lead time to activate an invoice customer was one full working day, and could easily take days or even weeks.

Filling out and processing a paper form with the customer’s information was just the beginning. Also required: company information for the customer’s employer, including verification of the party authorised to act on their behalf, and a credit request and assessment. Approvals and signatures are needed from multiple parties, requiring numerous manual steps which could include phone calls, emails and even sending documents by post.

Another issue was the credit assessment process, which was imprecise and unreliable, as it offered few credit limit options: SEK 10,000, 20,000 and 30,000. And it wasn’t necessarily clear to the company signer who in their staff had applied for the credit.

Din Bil needed a new onboarding process. They were looking for a way to activate new invoicing customers much faster, a process to increase customer satisfaction while minimising admin touch. And they needed better quality assurance both for the credit assessment process, and for ensuring that the right person and the right number of people sign the agreement.

Din Bil saw the Scrive-powered portal solution as a way to automate these steps and improve quality in a single, 100% digital process.

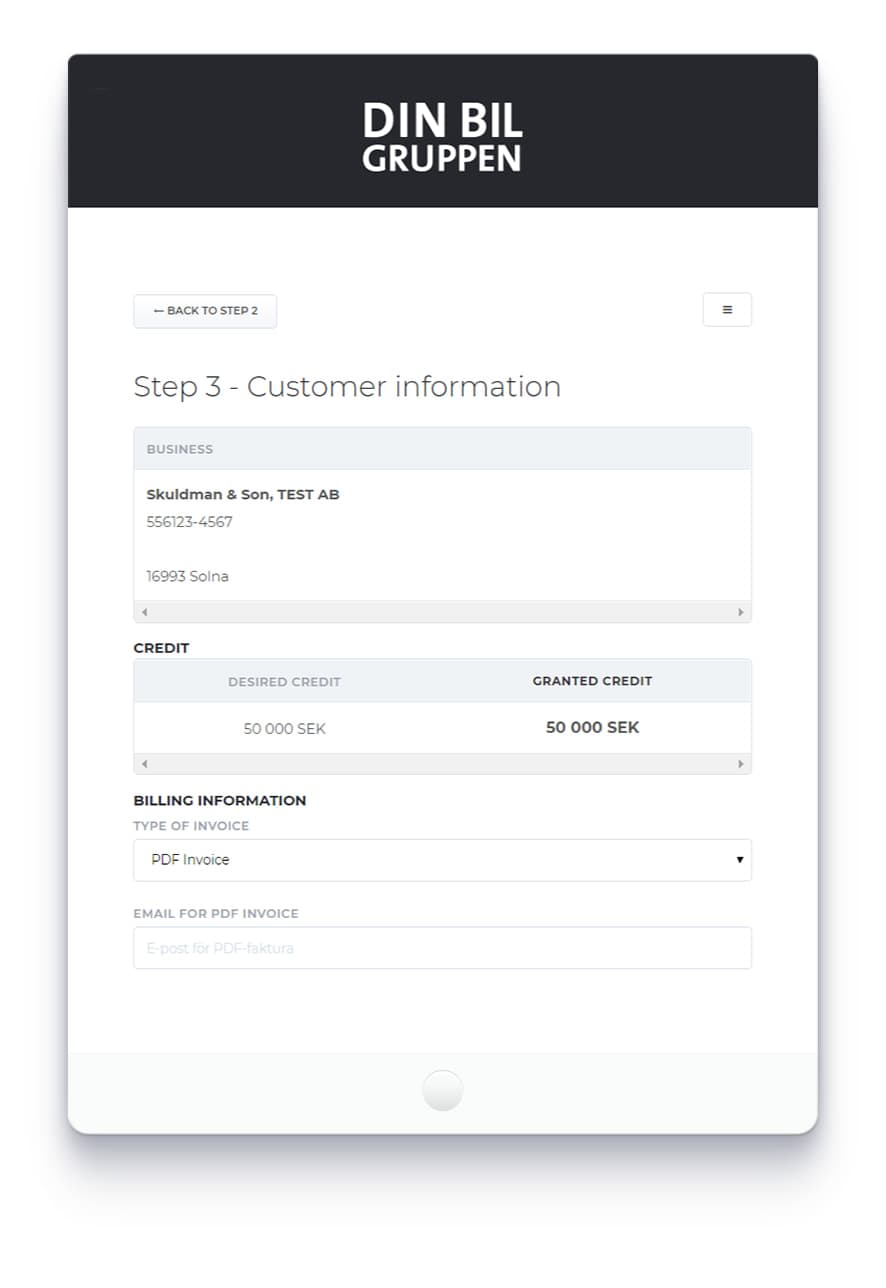

The entire workflow is managed within the context of the portal. Scrive’s automated process builds the digital agreement in real time and delivers the signed contract with minimal touch for all parties involved: Din Bil’s admin staff, the customer and the customer’s employers.

The Scrive solution met all of Din Bil’s goals for a fast and secure process involving the bare minimum of clicks and manual entry. It provides a faster response to the customer, a more reliable credit assessment process, a way for the company signer to know who in their staff applied for the credit, and the ability to sign the agreement at any time, on site or remotely.

“Scrive delivered just what we wanted: a simple, secure solution that shortens lead times and minimises button clicks and manual entry. In some cases, the credit is posted in just 15 minutes. Our customers are more satisfied, and the process is much easier for us.”

Din Bil can now activate a new invoice customer in just 30 minutes. The shortest lead time with the old process was one full working day, but it often took days or even weeks.

Customer satisfaction is up, and the number of admin steps has been dramatically reduced. The Din Bil manager can now hand the car over to the customer without having to wait for accounting staff to manually approve the credit. And because the Scrive process requires fewer signatures on Din Bil’s side, one less department needs to be involved. All documents are now stored digitally, further simplifying the work of admin staff.

The fast track for organisations to achieve authentication in all channels. Access all of Scrive’s identity services with a single integration, using either our dedicated REST API or OpenID Connect.

Request a meeting so you can tell us what you’re trying to solve, and we can look at how Scrive can streamline your business processes and bring value to your organisation.