2x

Conversion rates

Conversion rates for retail customers in Sweden and Norway rose from 30% to 65% and from 33% to 71%, respectively.

To keep pace as an online banking leader, Nordnet transformed their customer onboarding into a seamless, 100% digital process.

Conversion rates for retail customers in Sweden and Norway rose from 30% to 65% and from 33% to 71%, respectively.

In the first 20 days of going live, the volume of processed forms quadrupled for Norwegian stock savings accounts (ASK).

Occupational pension sales, involving 15-30 documents, previously took 5 days to a month to close.

Nordnet is a digital savings and investment bank headquartered in Stockholm. With 600 employees, its operations extend throughout the Nordics.

The first digital bank in the Nordics, Nordnet was founded in 1996 with the mission to challenge the financial world. And it has, being the first to digitalise stock trading. With lower costs and greater convenience, Nordnet offered customers a dramatic jump in value and more control over their savings and investments.

Nordnet understands that to achieve their goal of being the first choice in the Nordics for investment and savings, innovation is imperative. Today’s consumers have come to expect their bank to provide the same level of convenience we take for granted on e-commerce sites and other online services. To stay ahead, financial institutions have to figure out how to meet those expectations while staying in compliance with stringent regulations. And control their costs.

That’s why Nordnet is committed to building the best customer experiences by turning consumer trends and the fast pace of technology development into engaging services and products that are relevant for their customers.

"The effects we have seen in the customer journeys we have digitized and automated have been high above expectations. Over 50% higher conversion combined with considerably reduced lead times and better automated communication with our customers."

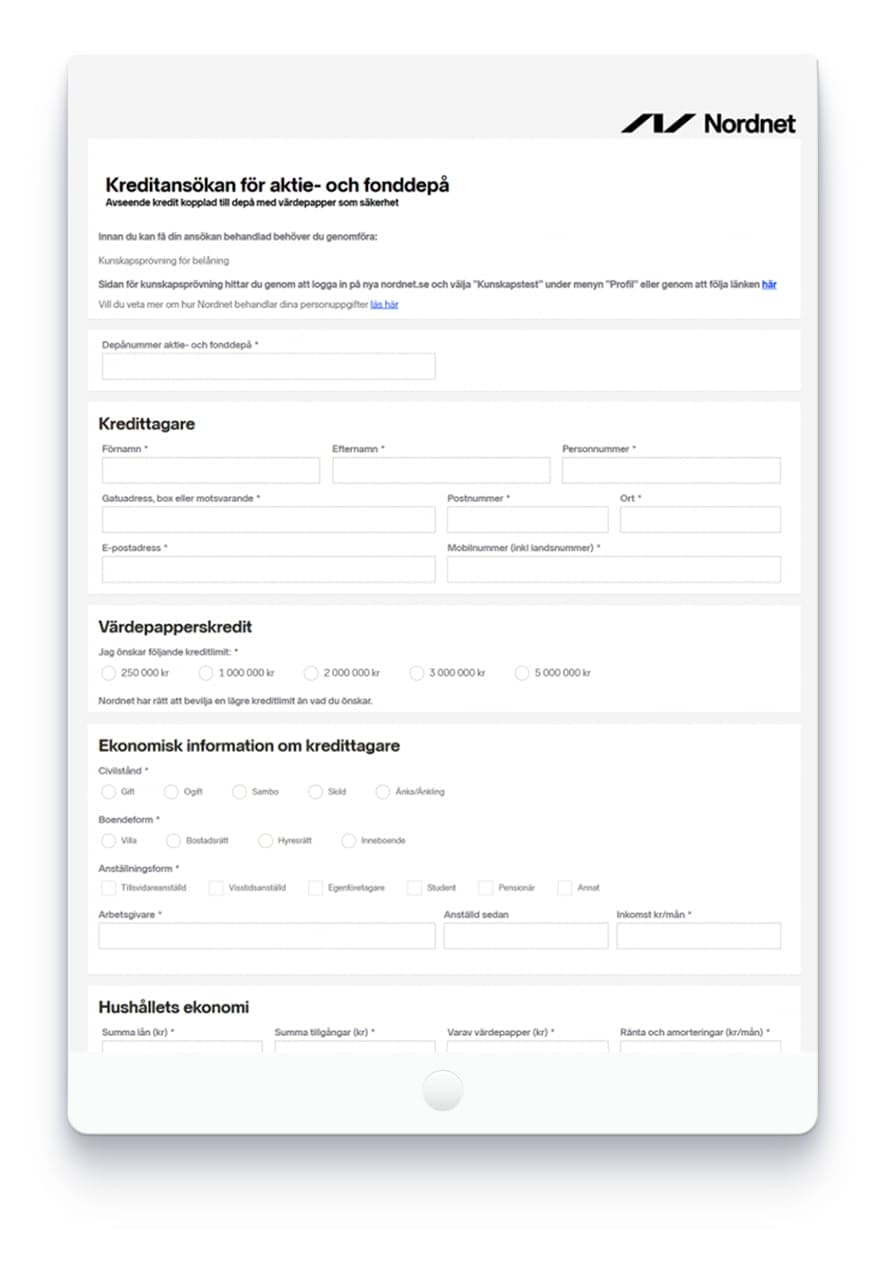

Nordnet identified their new customer onboarding process as a crucial area of focus if they were to give their customers a truly online banking experience. The “semi-manual” process they had in place was becoming unsustainable from both a customer experience and administrative standpoint.

Customers were able to fill forms online, but then had to print, sign and post them back. Not only was the process slow, some applications were returned incomplete, taxing admin resources and leading to customer frustration. Not to speak of the number of customers who simply abandoned the process at an earlier stage.

Internally, this process made Nordnet very dependent on its administration team, and the department was simply not scalable. If the number of incoming applications increased, more employees had to be hired to handle processing all the paperwork, including scanning various documents.

Another admin challenge was managing the online forms. Assistance from the IT department was needed whenever a form needed to be edited, or if a new one needed to be digitalised.

Nordnet chose a solution combining e-signing by Scrive and user-friendly digital forms by Scrive’s partner Sweet. The solution, a 100% digital process, allows customers to fill, sign and submit the onboarding forms online. Nordnet’s admin team can easily create, update and manage customer forms–without IT help. And: no paper forms to handle, process and store.

To meet security requirements, customers can authenticate themselves with eID when signing the agreements. The Scrive e-signing app supports eID authentication in all the countries where Nordnet operates, including Swedish and Norwegian BankID, Danish MitID and FTN in Finland.

For forms requiring several different signatures, the Scrive workflow engine routes the form to the various signing parties and collects all the signatures, making it easy for the admin team to track and monitor each stage of the signing process. And to ensure that each signed agreement is legally binding, Scrive’s industry-leading evidence log is attached to each document before it is digitally sealed to tamper-proof it.

Storing customer data in the cloud is a step few banks have taken, and the security and compliance safeguards offered by Scrive and Sweet gave Nordnet the confidence to go ahead with this pioneering development.

For customers, the process of opening a new account at Nordnet now takes only a few minutes. The previous process took at least a week. No more printing out agreements to sign and send back by regular mail. Everything can be done directly online at Nordnet’s website.

Nordnet’s administrators can now upload and administer digital forms, such as agreements and applications, saving significant time and internal resources.

The solution was first rolled out in Norway, for stock savings accounts (ASK). In the first 20 days of going live, the volume of processed forms quadrupled. The continued rollout met with success for retail customers in Sweden and Norway, where conversion rates rose from 30% to 65% and from 33% to 71%, respectively.

For complex B2B onboarding processes, consider the solution’s impact on Nordnet’s occupational pension sales in Sweden.

A typical business deal involves 15-30 documents, most requiring one or more signatures. 500 such deals per year is normal, and lead times with the old process ranged from 5 days to a month, with repeated reminders needed to close the deal. Signatories could easily forget to sign a document or have questions, all slowed down by mailing times. These delays created a loop where deals could easily break down.

The new process takes 1-5 minutes from sending the digital agreement to closing the deal.

The fast track for organisations to achieve authentication in all channels. Access all of Scrive’s identity services with a single integration, using either our dedicated REST API or OpenID Connect.

Seamlessly integrate the full power of Scrive’s easy-to-use and secure eSign API, guided every step of the way by Scrive’s expert support team.

Request a meeting so you can tell us what you’re trying to solve, and we can look at how Scrive can streamline your business processes and bring value to your organisation.