Advanced eSign journeys

Discover some of our various advanced features and their valuable applications. They are built to accommodate the wide range of requirements our customers have in their day-to-day workflows.

You need to accept marketing cookies to see the video.

Bottlenecks in your signing process

Imagine you’re trying to get a project off the ground and you need sign-off from a few different departments. This could be a number of different stakeholders within each department but in order to get a signature you need to address the agreement to a specific person.

You find yourself chasing legal, revenue, product, and marketing departments, all in an effort to obtain not only a signature but even just to identify who among them can provide you with that all-important signature to get the ball rolling. This process can easily become a major time sink. Additionally, it can create a significant bottleneck that has the potential to slow down your projects or even stop them in their tracks

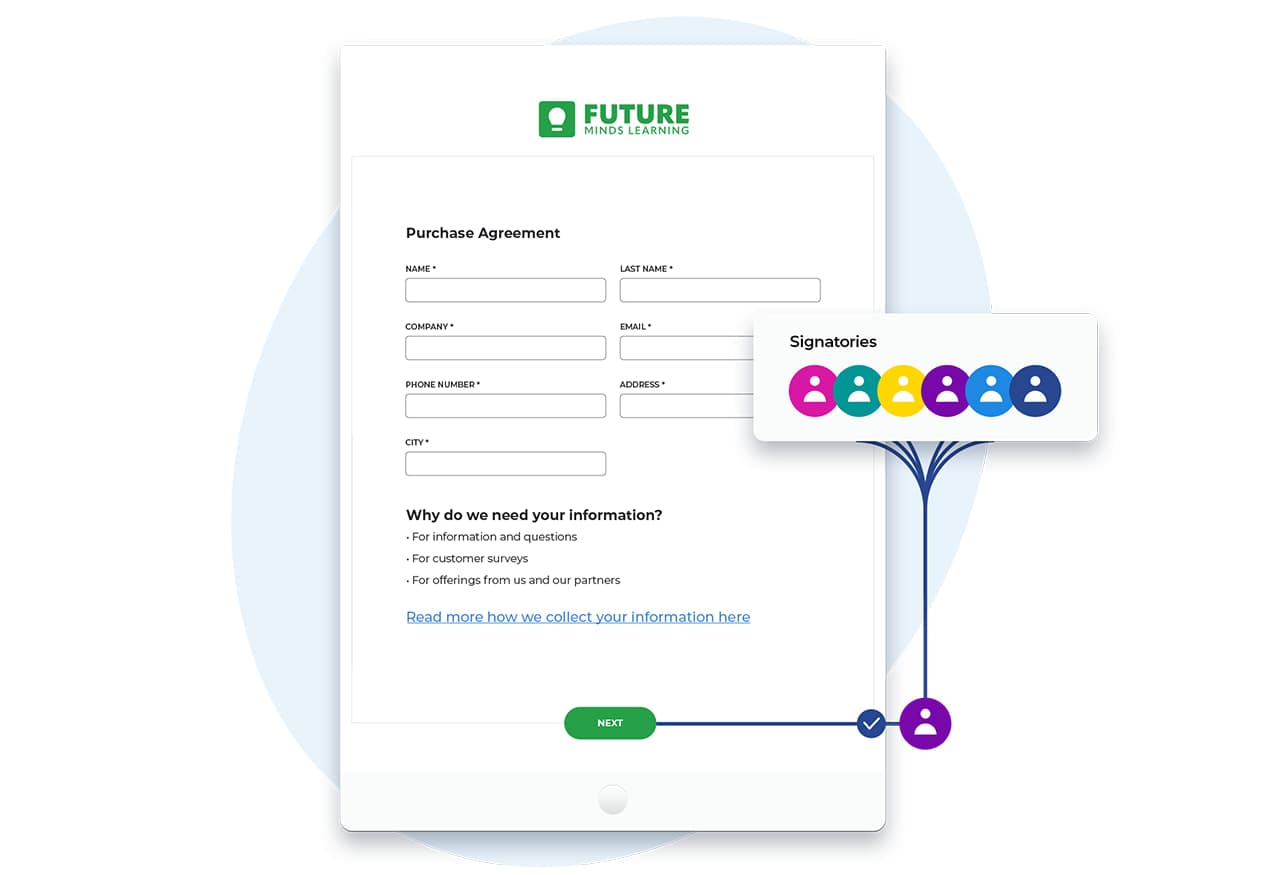

Signing groups is the solution

Signing groups allow you to set up logic for signatures, requiring just one, a specific number, or all members of a group to sign. This feature prevents project delays by ensuring quicker approvals, allowing you to customise the approval workflow to fit your needs.

Use cases

Board Meetings:

Streamline minute-signing with a group where any 2 of 5 board members can validate documents, enhancing efficiency without compromising accuracy.

Company/Legal Entities:

Customise signing rules to streamline agreements and enhance interdepartmental collaboration. Simplify compliance and improve customer experience with predefined signing combinations.

Mergers & Acquisitions:

Efficiently manage document flows during acquisitions by assigning departmental groups for signing, avoiding bottlenecks and ensuring agility in a dynamic business environment.

Send and sign documents in a bundle

Many processes require you to send multiple documents to an individual or a business, some or all of which may require signatures.

Managing this can be a real challenge for everyone involved. From ensuring that the right documents are viewed and signed in the correct order to making sure that everything is stored and sorted correctly once they’re all signed, there’s a lot to handle.

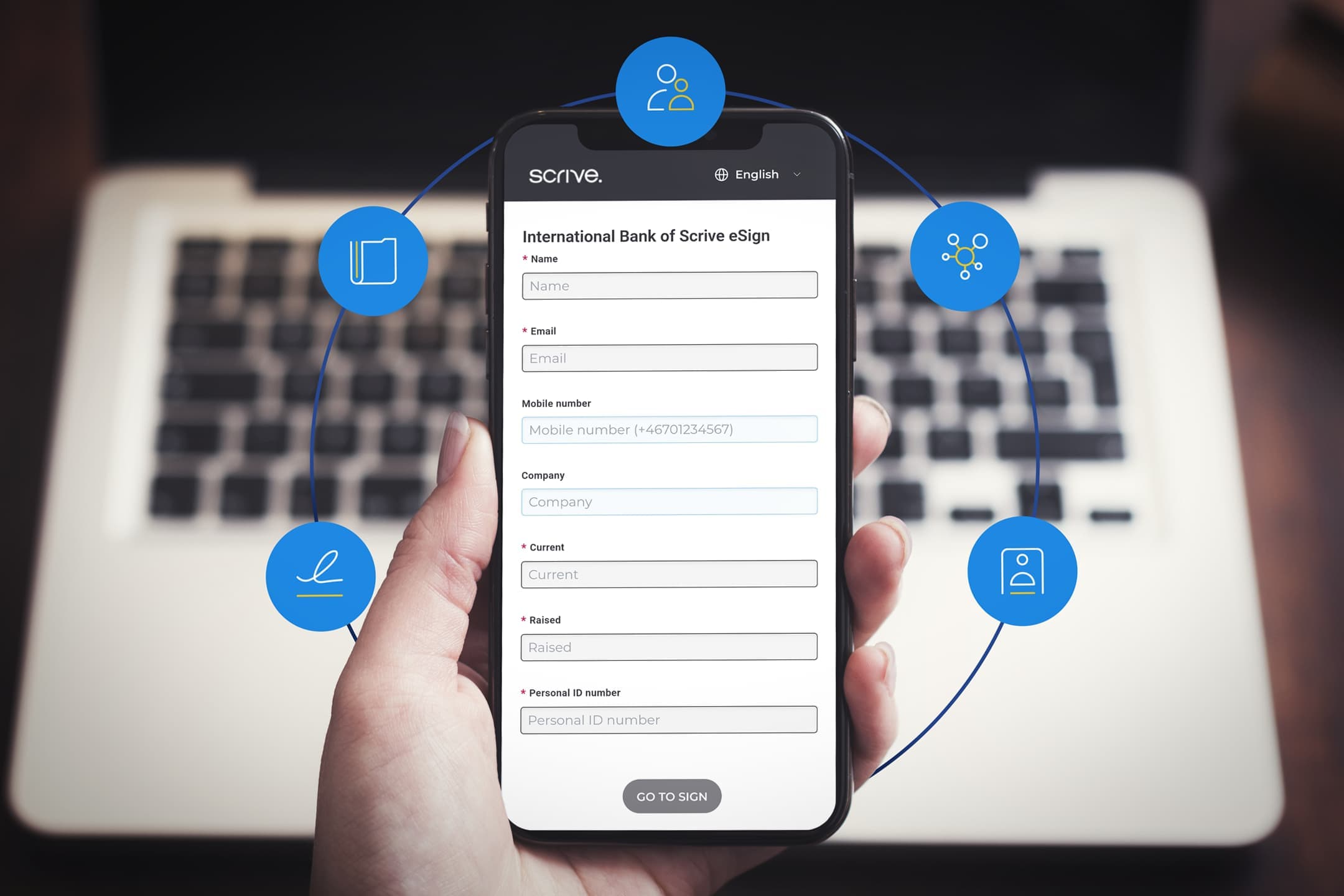

For example, consider loan applications. Not only are there several documents to sign, but there are also forms to fill out and data to collect in order to complete the loan application.

The solution

Sending all documents together and enabling your customer to both receive them and sign them as a single bundle saves time and simplifies the process of archiving the information for future reference.

If you use eIDs in the signing process you also cut down on costs by only having to authenticate one transaction rather than once for each document.

With Scrive, you’re able to streamline cumbersome, time consuming and expensive multi-document processes, configure your workflow to send, and sign, bundled documents with a single signature and store the signed documents in a simple way, either in Scrive’s e-archive or a cloud storage of your choice.

Use Cases

Real Estate:

New tenancy agreements and disclosures are usually made up of more than a single document. Simplify transactions by letting clients receive and sign all necessary documents in one go, enhancing efficiency and customer experience.

Finance:

Improve compliance and customer satisfaction in banking and finance by enabling one-step signing for loan and insurance documents, boosting efficiency and reducing errors.

Complex compliance requirements

Compliance is crucial for businesses, particularly in heavily regulated industries dealing with high monetary values, sensitive information, and high fraud risk. Effective compliance checks are vital in banking, financial services, automotive sales or financing, insurance, and other sectors prioritising privacy and security alongside customer experience.

Scrive’s advanced authentication and data collection tools facilitate essential compliance checks, like KYC, enabling quick data verification (e.g., customer addresses, driver’s licences) to prevent fraud without slowing down processes. Navigating KYC and AML compliance’s complex and evolving standards is challenging, but Scrive’s focus on legal compliance and regulatory insights makes us a preferred partner for businesses with extensive compliance needs. Read more about how we help heavily regulated businesses

Are these scenarios familiar to you?

If so, these features could make your work that much easier! With our API you will get access to advanced capabilities with the possibility of tailoring eSign features to your specific needs with customisable workflows.

Make your user experience smoother, lower your transaction costs and operational expenses, and keep sensitive data safe while following legal rules. Contact us today, and our expert support team will help you every step of the way.