Customer onboarding: A key to success

The first step of the customer journey is a crucial moment for risk mitigation. It involves addressing various risks such as fraud, compliance, security breaches, and perhaps the biggest risk of all: customer frustration and abandonment. Scrive understands that addressing these risks with the right digital solutions, combined with a good dose of common sense and empathy, is essential. It's the fast road to converting satisfied customers while making your business safe and efficient.

Making onboarding simple with a single digital flow

Onboarding isn’t about cutting corners; it’s about automating tasks, like compliance checks, to make everything smoother. Scrive makes it easy.

Fast and secure

Our solutions are built for compliance, including AML, GDPR, and eIDAS.

No customer frustration

We respect your customer’s time and effort during onboarding.

Practical solutions, no fancy tech

We focus on common sense, customer-friendly design, and getting things done quickly.

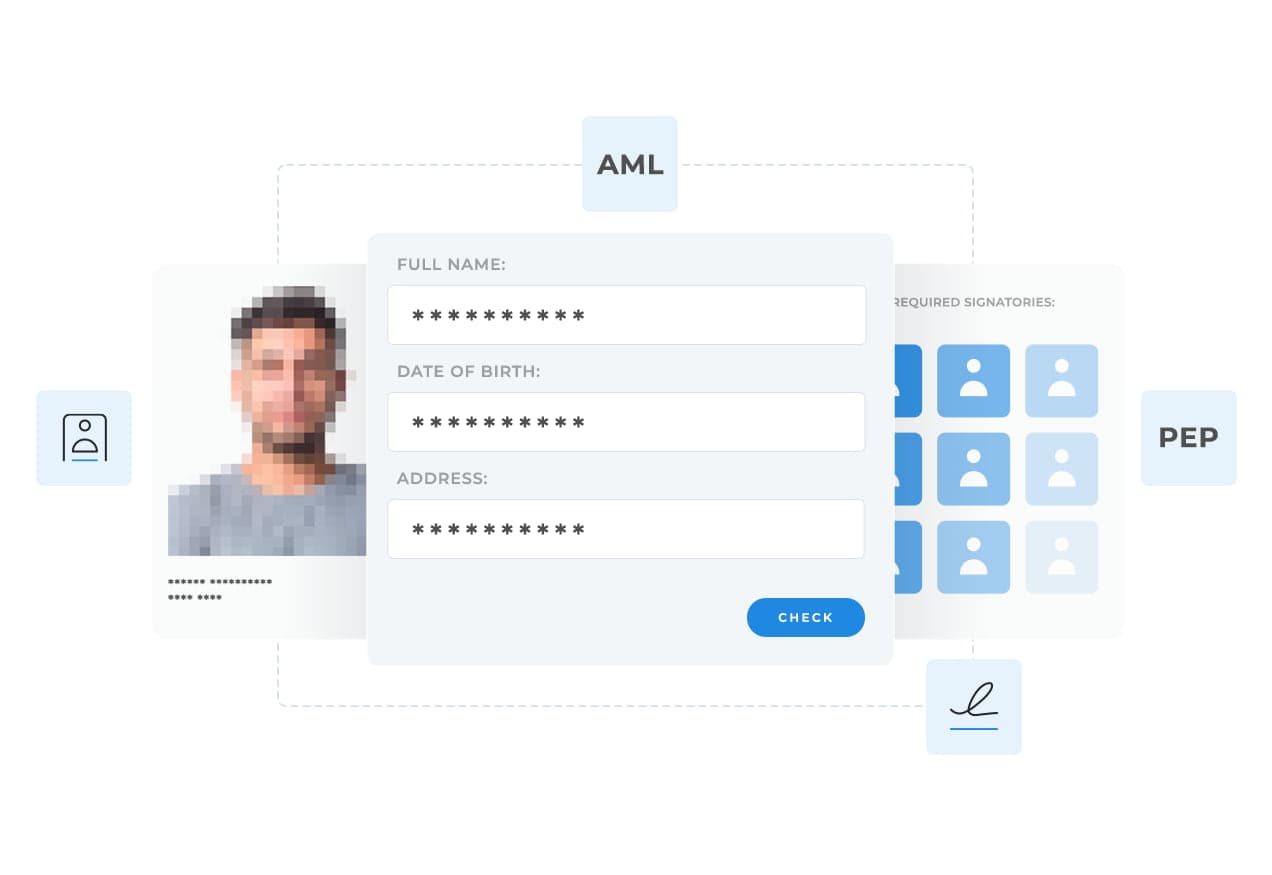

Simplifying business verification processes

B2B onboarding can be complex and costly. Simplify AML compliance, KYB processes, and credit approvals by automating:

- ID checks

- Verification of beneficial owners and required signatories

- PEP and sanctions lists checks

You need to accept marketing cookies to see the video.

Data lookups

Instant data lookups facilitate the quick and secure capture of information. This ensures continuous compliance diligence throughout the onboarding process.

Building a modern onboarding flow

It’s less about flashy tech and more about common sense and empathy for your customers during the onboarding process. Let’s dispel some common misconceptions about going digital. To understand the Scrive approach to the onboarding process, we’ve gathered insights from seasoned experts. Learn how to express your company culture through technology without long, expensive integration projects. The basic tools you need for the onboarding process are easy to implement with minimal business disruption.

“Imagine a bank offering a great customer experience. They’d take over tomorrow.” Roaring.io’s Pontus Holmberg gets to the heart of what’s at stake when it comes to marrying compliance and CX.

Get eBook

The “Nordic way” is going global. Learn more about how Scrive brings compliance and CX together in this eBook. Customer Due Diligence doesn’t need to be overly daunting, yet KYC and KYB interrogations tend to be uncomfortable.

Learn more about how Scrive brings compliance and CX together in this eBook.