Roaring

Automation of KYC and B2B onboarding processes. Scrive’s connector to Roaring facilitates seamless access to accurate, up-to-date business information.

From investment agreements to identity verification and secure online payments, Scrive delivers robust digital solutions with a 99.99% uptime. These solutions simplify, streamline, and enhance your financial processes.

At Scrive, we provide complimentary technical support throughout the entire development process, ensuring you receive the guidance you need at every step. Each client is assigned a dedicated industry project manager who offers expert advice and prompt assistance. With Scrive, you can anticipate an efficient onboarding process, faster time to market, and a higher return on investment.

“Scrive makes my job so much easier! Having the ability to scale to a growing number of countries with one integration rather than having to work on a new integration for weeks or months for each eID is what makes me crazy about your product.”

"The result is a fantastic customer experience. We went from 12% to 0% errors and can now pay our resellers within 30 minutes instead of days or weeks."

"The effects we have seen in the customer journeys we have digitised and automated have been high above expectations. Over 50% higher conversion combined with considerably reduced lead times and better automated communication with our customers."

Benefit: Provides an additional layer of security for significant financial transactions, safeguarding both the institution and its clients. We ensure that every transaction is secure, thereby enhancing trust and confidence in your financial operations.

Benefit: Facilitates quicker execution of high-value corporate agreements by allowing all parties to sign documents electronically from anywhere. This improves efficiency, ensures compliance with legal standards, and accelerates deal closure times, providing a competitive advantage.

Benefit: Our services provide a smooth and efficient experience for your high-net-worth clients, ensuring the secure handling of all high-value contracts. This approach enhances client satisfaction and fosters long-term trust and loyalty.

Benefit: Ensures that only authorised individuals can access sensitive financial information, enhancing overall security.

Benefit: Our solutions guarantee robust identity verification, substantially mitigating fraud risk and ensuring complete compliance with AML regulations, safeguarding both your business and customers.

Benefit: Our solutions simplify the process of formalising investments, ensuring quicker and more secure transactions. We enable faster processing times and enhanced protection for your financial activities, ensuring each transaction is handled with the highest security and accuracy.

Benefit: Facilitates secure and compliant international transactions, ensuring that both parties meet the necessary legal requirements and reducing the risk of fraud in global financial operations.

Benefit: Prevents fraudulent transactions by verifying the payer’s identity before processing the payment. This enhances the security of online transactions, significantly reduces the risk of chargebacks, and minimises fraud-related losses for financial institutions.

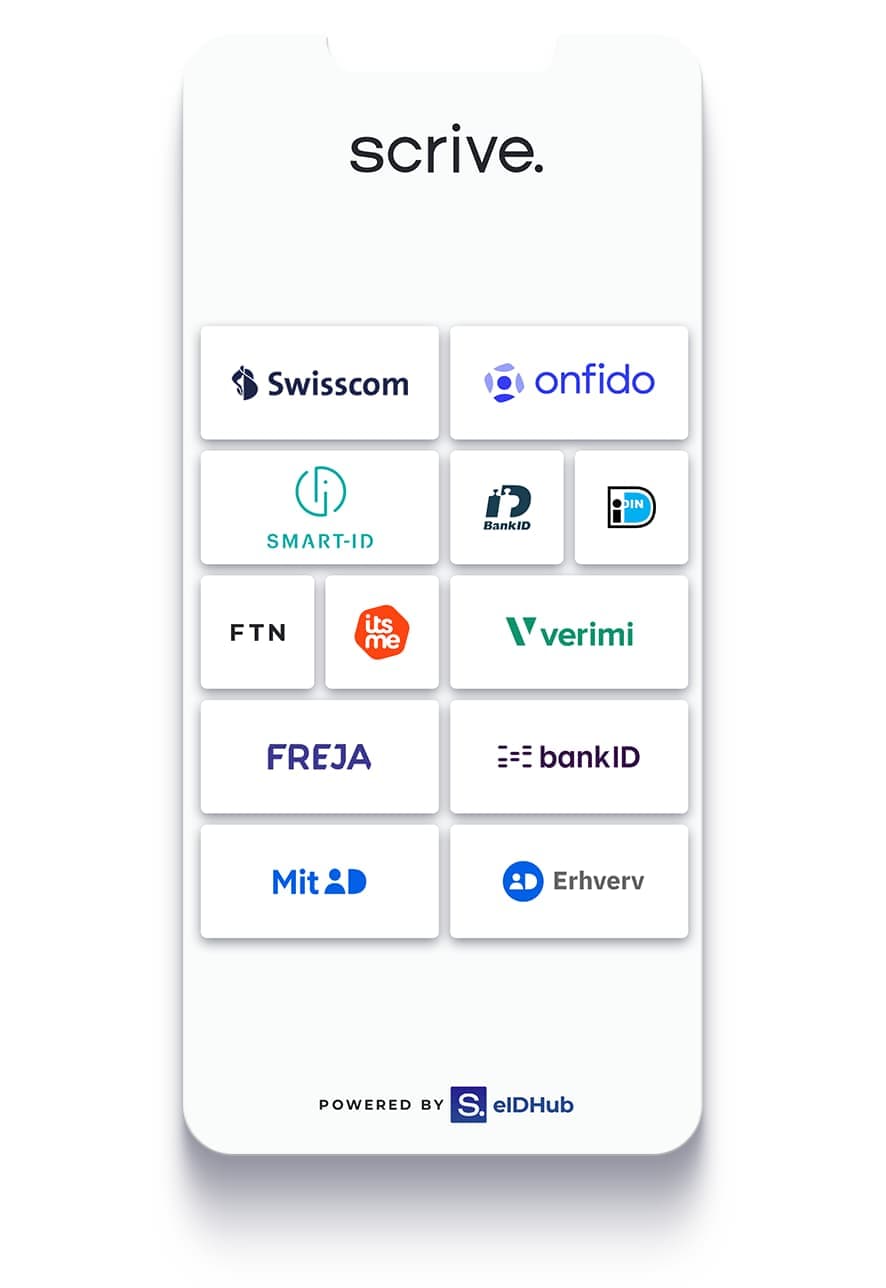

QES is the highest level of electronic signature as defined by the eIDAS regulation. As a Qualified Trust Service Provider (QTSP), Scrive offers an innovative solution—Scrive QES—that makes it easy and affordable to sign with QES from Scrive’s eSign platform. Scrive also offers QES services through trusted EU providers like Swisscom and Verimi.

Scrive’s eID Hub is a robust identity verification tool, ensuring secure transactions while complying with anti-money laundering regulations. These features are paramount for the finance industry, guaranteeing both security and compliance.

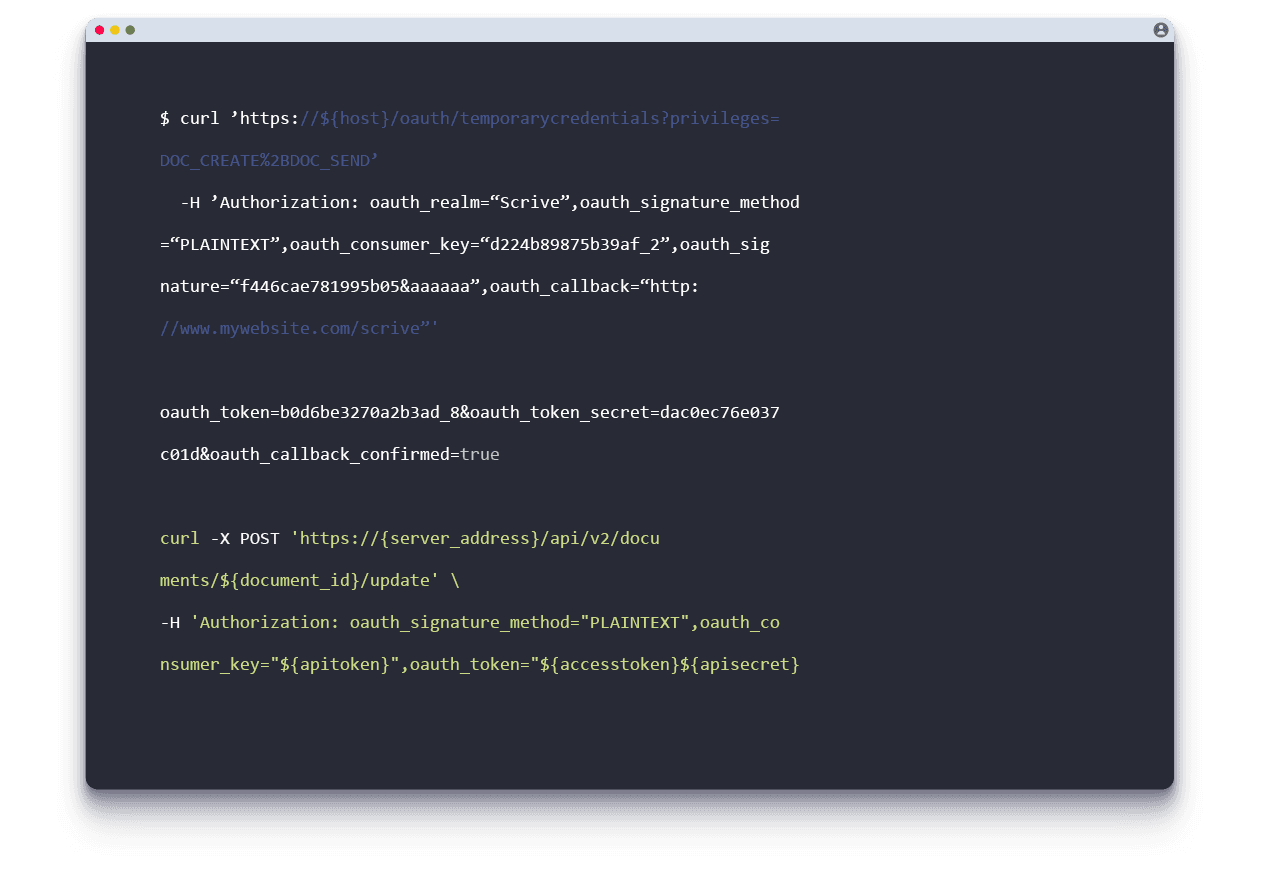

Scrive’s API solution offers significant advantages for the finance industry. It adheres to stringent security standards, including eIDAS regulations, which are crucial for maintaining compliance. The API seamlessly integrates into existing systems, allowing financial institutions to enhance their technology without significant overhauls.

Sign up for a FREE API testbed account

Scrive’s solutions not only meet but surpass the stringent requirements of eIDAS for electronic signatures. We furnish clients with a robust evidence package, ideal for those with a low-risk tolerance, ensuring all legal evidence is securely attached to the signed PDF for effortless reference. Leveraging blockchain technology, our system fortifies your signed contracts against forgery while maintaining exceptional data protection standards, guaranteeing compliance with global data retention requirements. With our expertise in digital lending, digital transactions, and iGaming, we cater to all your needs in the modern financial landscape.

Read more about why other companies have decided to switch to Scrive.

Automation of KYC and B2B onboarding processes. Scrive’s connector to Roaring facilitates seamless access to accurate, up-to-date business information.

Sweet Systems is a Swedish IT company specialising in digital innovation. With expertise in CRM, automation, digital forms and dashboards, Sweet optimises the work of sales, support and marketing departments. Thanks to the integration with Scrive, Sweet offers customised digital forms complemented by seamless e-signing.

Uniify simplifies the process of collecting customer data, meeting KYC, KYB and credit assessment requirements, while saving time, reducing costs and improving the customer experience.

Leading provider of bank account information services based on modern open banking technology. Licensed Payment Institution under the supervision of the Swedish Financial Supervisory Authority (Finansinspektionen).

Microsoft’s mobile, intelligent Intranet helps organisations share and manage content, knowledge, and applications with colleagues, partners, and customers.

Read about the integration

Dynamics is a line of CRM and ERP applications that forms part of "Microsoft Business Solutions".

Read about the integration