Nordnet

Double conversion rates

Digitalising their onboarding process using Scrive eSign and securing it with eID verification, Nordnet doubled their conversion rates and quadrupled the volume of processed forms in the first 20 days of going live!

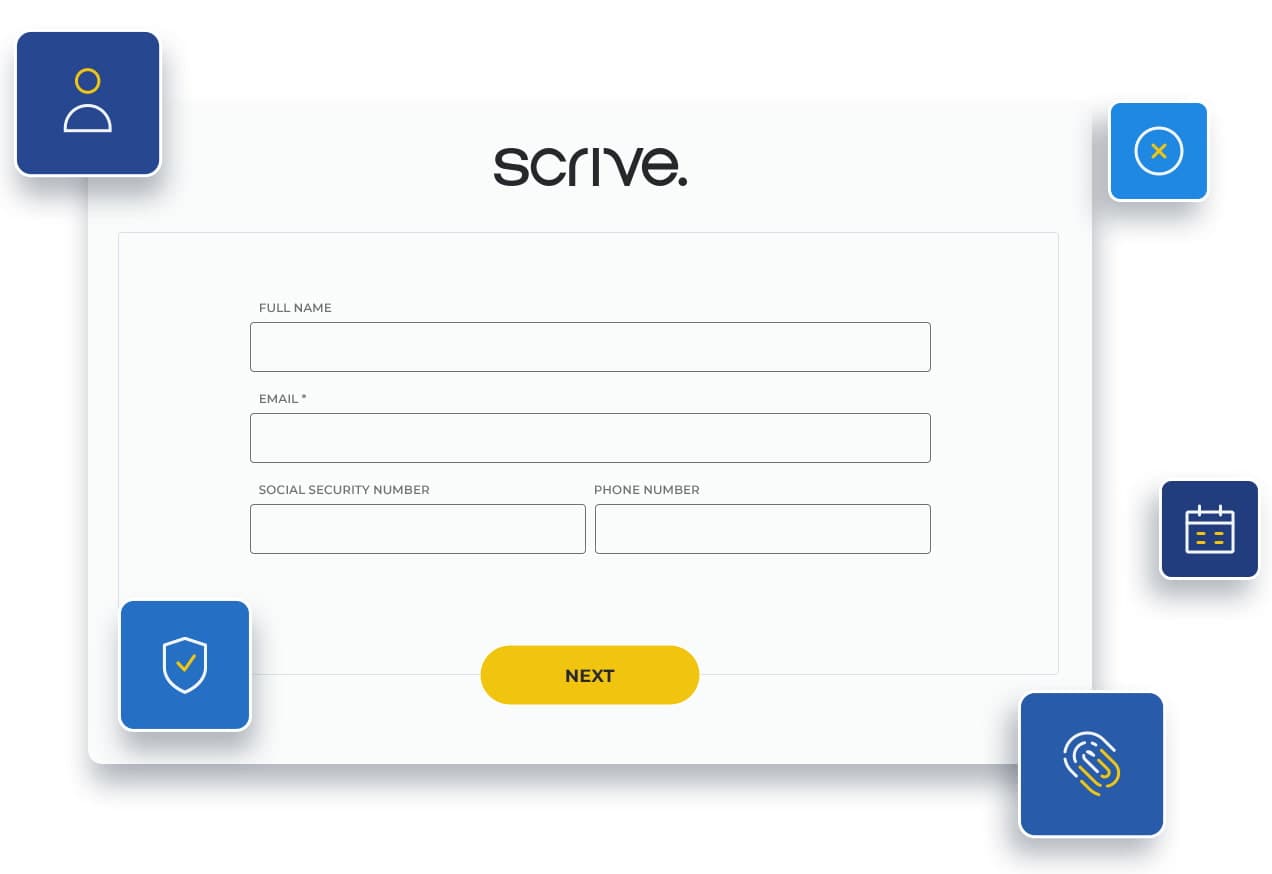

Manual, analog processes are slow, costly and error-prone, resulting in customer frustration, abandonment and operational inefficiency. Scrive's answer? Faster, smarter lending powered by e-signing and digital ID verification.

Fast time to market, end-to-end, digital solutions to automate onboarding and ongoing AML/KYC processes.

Digitalising their onboarding process using Scrive eSign and securing it with eID verification, Nordnet doubled their conversion rates and quadrupled the volume of processed forms in the first 20 days of going live!

By using Scrive’s eSign API to build a streamlined mobile POS system, DNB cut their error rate down from 12% to 0% and reduced their payout time from 5 days to 30 minutes! Previously, contract errors meant the entire process had to be repeated, which could take days.

Working closely with both business development and legal, Scrive was able to help Avanza digitalise what used to be a slow, manual and paper based onboarding process. By doing this, Avanza saw a 72% decrease in total average onboarding time while volume of accounts quadrupled, as well as a 20% increase in total deposits in the first year of rolling out Scrive eSign.

Scrive understands that reducing drop-offs is the name of the game: the road to higher revenue and customer loyalty. Delight your customers and simplify your administration by completing your onboarding and compliance processes in a single digital flow.

Hypoteket worked with Scrive to create a fully digital, more customer-centric lending process.

“We knew we couldn't really revolutionise the mortgage market without digitalising the full onboarding journey for the customer. And that's what we did together with Scrive.”

Take a big burden off your compliance team with integrated data lookups that fetch validated compliance data and auto populate your agreements, ready for e-signing. No need to manually collect and verify company information, required signatories, sanctions list checks and more.

Are your lending processes stuck in the past, burdened by paper, delays and security risks? If you're ready to revolutionise the way you do business, find out how Scrive can guide you with scalable solutions that enhance customer experience, unlock efficiency and simplify compliance.

Contact our experts today for a personalised demonstration and see firsthand how security and efficiency can revolutionise your lending operations.

Contact us